- Renewables Rising

- Posts

- Africa's digital boom fuels green data centres demand

Africa's digital boom fuels green data centres demand

From the newsletter

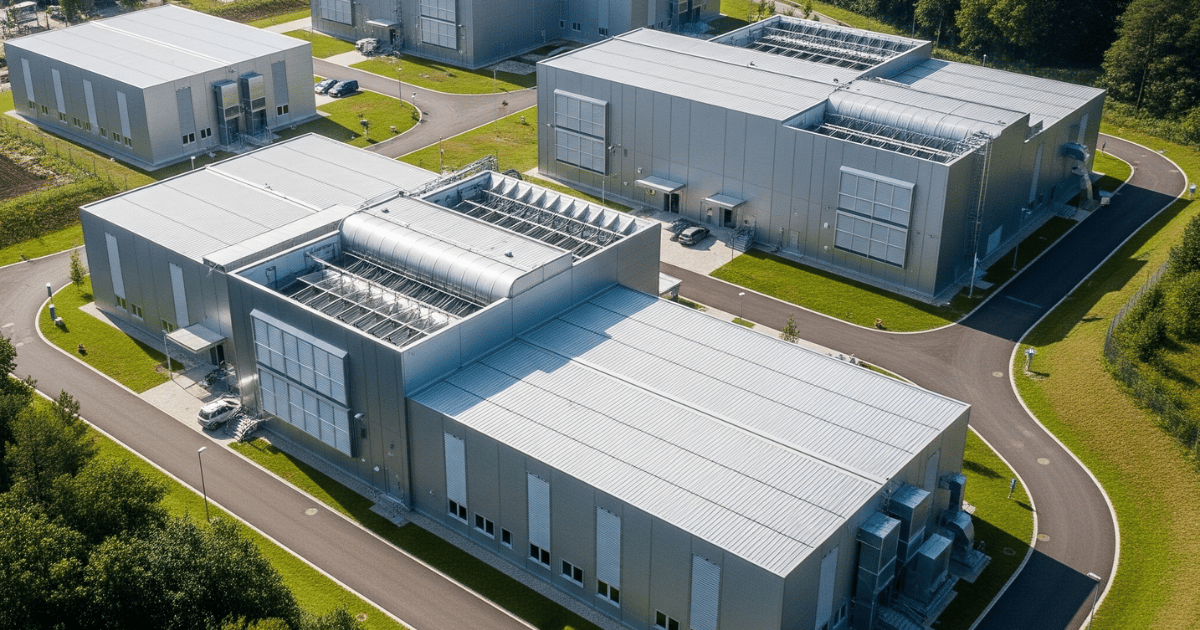

Morocco plans to build a 500 MW data centre powered by renewable energy. This aligns with Africa's wider move towards self-generating green energy for data facilities, driven by cost savings and reliability needs. As the continent rapidly embraces digitalisation, the need for more data centres and clean power is expected to grow significantly in the coming years.

Morocco plans to invest $1.22 billion in its digital modernisation strategy, which includes artificial intelligence and expanding fibre optic deployment to ensure that sensitive data can be stored and processed within its borders.

Many other African countries are investing heavily in digitalisation, with the expected number of internet-connected devices projected to reach 1.1 billion by 2029, almost double the current figure. This will drive the demand for data centres and power.

More details

The planned Moroccan data centre will be located in Dakhla, in Western Sahara. So far, however, details on the timeline or cost have not been made public. The country's digital roadmap, which aims to make it a hub in the north, has attracted several entities with announced plans for more than 10 data centres. Some of these include US AI infrastructure startup Iozera.AI, which plans to build a 386 MW data centre, and Korean company Naver, which is teaming up with Nvidia and Nexus to build a 500 MW AI data centre.

Africa's data centre market, while still relatively small, is rapidly growing. Projections indicate the market will reach $3 billion in revenues by 2025 and $5.4 billion by 2027. Currently, it accounts for less than 1% of global data centre capacity. There are at least 176 data centres listed across 33 African countries, with South Africa leading the continent with 47, followed by Morocco (23), Kenya (18), and Nigeria (16). Recent developments in Morocco, however, position it as a market to watch closely.

African data centres employ diverse strategies to secure power, often blending grid reliance with self-generation. While many are connected to national grids, the inherent unreliability of power infrastructure in many parts of Africa makes a backup plant necessary. Diesel generators have served as the primary backup power source for a long time. But lately, data centre operators are embracing hybrid models that integrate renewable energy sources, aiming to reduce dependence on fossil fuels due to frequent global supply chain disruptions and price increases.

The new and upcoming data centres are primarily sourcing their power from renewable energy. In Kenya, ADC is targeting a 1 MW solar system to support its data centre in Nairobi. iCOLO has installed a 200 kW solar solution that supplies approximately 40% of its demand. In SOUTH AFRICA, Teraco plans to power 50% of its data centres with renewable energy by 2027 and 100% by 2035 and is building a 120 MW solar plant. In Ghana, ONIX has built a 726 kW solar plant to meet its daytime load.

Africa's data centre capacity is set for significant expansion in 2025, with nearly 350 MW of IT load projected to come online. Key projects include Teraco's JB7 data centre in South Africa, adding 40 MW of IT load, and IXAfrica's second hyperscale facility in Kenya, contributing 53 MW. A positive aspect is that a substantial portion of their electricity will be sourced from renewables, with solar plants already under construction. In South Africa, some data centres will also use wheeling agreements to obtain power from distant plants.

The decreasing costs of renewable energy technologies offer considerable advantages to high energy-consuming sectors like data centres. New policy frameworks, allowing companies to procure power directly from Independent Power Producers (IPPs), will also greatly support the industry, especially those who find building their own power plants too expensive.

Battery energy storage solutions are now becoming less expensive and widely adopted for balancing the intermittent nature of renewable sources. Moreover, data centres that operate their own power plants can participate in grid balancing services, transforming their backup assets into a valuable resource for grid stability and a potential source of revenue.

Our take

The frequent increases in grid electricity tariffs, coupled with unreliable service, will continue to act as a catalyst for data centres to adopt renewables. We expect new data centre establishments to rely heavily on renewable power generation.

Declining technology costs for solar and battery energy storage, combined with policy frameworks that allow net metering, will be a boon for data centres. They need not worry about excess capacity, as they can inject it back into the grid and generate additional revenue.

With the growing presence of digital services in Africa, more data centres will be established. Given their high energy consumption and stable revenue flow, investors will target this segment. Their high energy consumption allows investors to recoup their investment within a short time if deals are structured through Power Purchase Agreements.