- Renewables Rising

- Posts

- Africa's industries turn to private power generation

Africa's industries turn to private power generation

From the newsletter

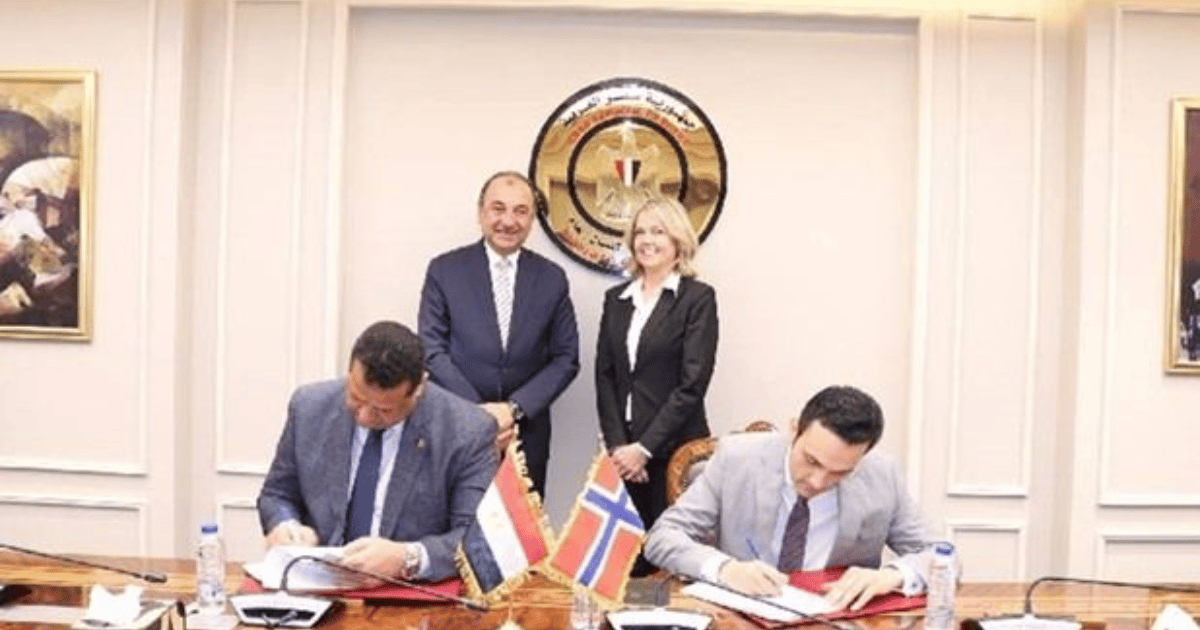

Egyptalum, a subsidiary of Cairo-based Metallurgical Industries Holding, has signed a deal with Norway-based renewable energy firm Scatec to develop a 1,000 MWh solar plant. This deal follows Egypt's recent approval of four private-to-private power generation plants, totalling 400 MW and serves to reduce energy-intensive industries' reliance on the grid.

Egypt's industrial and commercial sectors consume over half of its electricity. With post-COVID industrial growth and an increase in residential cooling demands, the government is fast-tracking private-to-private power generation to ease grid strain.

This trend is noticeable in many African countries. Kenya, South Africa, Ghana, Nigeria, and Zambia have all updated their policy frameworks to support independent power generation for industrial customers.

More details

The project is estimated to cost around $650 million and will be built in two years in two phases, each with a capacity of 500 MWh. The plant will also have battery storage of up to 200 MW for reliability. Under the agreement, Scatec will fully finance, construct, and operate the solar facility through a power purchase agreement (PPA).

This initiative is particularly timely for Egyptalum, which exports approximately 50% of its products, primarily to the European Union market. The project will not only reduce operational costs and boost production efficiency but also strengthen its position in international markets by supplying low-carbon products. This is crucial given the European Union's adoption of the Carbon Border Adjustment Mechanism (CBAM), which taxes high-carbon-intensive products and is set to take full effect next January.

Egypt's industrial sector has shown positive growth recently, with a 4.77% expansion in the third quarter of the 2024/25 fiscal year. This growth was largely driven by a strong performance in the manufacturing sector, which surged by 16.3% in the same period, reversing a previous contraction. The government is also actively pursuing strategies to further develop the industrial sector, including streamlining licensing, improving access to finance, and offering incentives.

In a move to spur investments in energy and other critical infrastructure, the Egyptian government has extended specialised treatment to one of the world's largest sovereign wealth funds, the Abu Dhabi Developmental Holding Company, by offering broad tax exemptions on its investments within Egypt.

Across many African countries, commercial and industrial customers largely depend on the national grid due to limiting policies concerning self-power generation. However, this is changing fast. More than twelve countries participating in the World Bank's "Mission 300" initiative are implementing sweeping policies to increase private sector participation in power generation. Some other countries already have mature policies; for instance, South Africa allows the wheeling of power to private establishments, and Zambia takes just two days for project approvals.

In 2024, approximately 419 MW of solar capacity was added by commercial and industrial customers. However, most of these large-scale projects were seen mainly in South Africa, which accounted for half of the total capacity installations. It was followed by Nigeria at 62 MW, Ghana at 26 MW, Kenya at 17 MW, and Zimbabwe and Zambia, both at 14 MW. All these countries continue to face power deficits and high tariffs, which are driving the move to captive power generation.

Our take

Utilities face a threat of revenue loss as high-energy-consuming industrial clients shift to self-generated power. This exodus directly jeopardises utilities' operational stability and expansion plans. To prevent further decline, they must adapt their business models.

Across many countries, utilities are raising electricity tariffs to ensure profitability. This strategy, however, makes on-site power generation increasingly appealing to businesses, especially with the continuous fall in solar panel prices. Consequently, more C&I consumers are expected to opt for their own power solutions.

For the C&I solar sector to achieve faster growth, there is need for streamlined licensing processes, supportive government policies like net metering, and the availability of local financing options. Additionally, continued de-risking mechanisms are essential to attract greater private investment for a wide array of C&I projects.