- Renewables Rising

- Posts

- Africa’s top employer taps renewables to unlock growth

Africa’s top employer taps renewables to unlock growth

From the newsletter

Africa’s agricultural sector employs more than 60% of the population and contributes up to 40% of GDP in some countries. Yet, this powerhouse consumes barely 2% of Africa’s total electricity, relying heavily on outdated fossil fuel-based technologies. The launch of the Agri-Energy Coalition this week marks a critical moment to change this imbalance.

The coalition brings together leading organisations from the agriculture, energy, and development sectors to deliver sustainable and scalable solutions that transform food systems through integrated energy access.

Demand for energy in agriculture may double by 2030, with agro-processing alone accounting for about 6 GW of total potential demand. If harnessed well, this could eventually rival the demand created by urban electrification programs.

More details

The alliance was launched at the 2025 Africa Food Systems Forum in Dakar, Senegal, bringing together leading organisations such as GOGLA, the Global Energy Alliance for People and Planet (GEAPP), the IKEA Foundation, and GIZ, among others. Its common goal is to modernise African agriculture through coordinated policy action, targeted investment, and technology transfer. Importantly, it positions agriculture not only as a food security agenda but also as a major growth driver for Africa’s energy sector.

With the projected demand for energy in agriculture set to double by 2030, the alliance seeks to channel this demand into a sustainable, renewable-driven model that benefits both farmers and power providers. Already, there is a growing urgency to decouple the agricultural sector from diesel generators, which currently power much of Africa's irrigation and processing, locking farmers into high costs and carbon emissions.

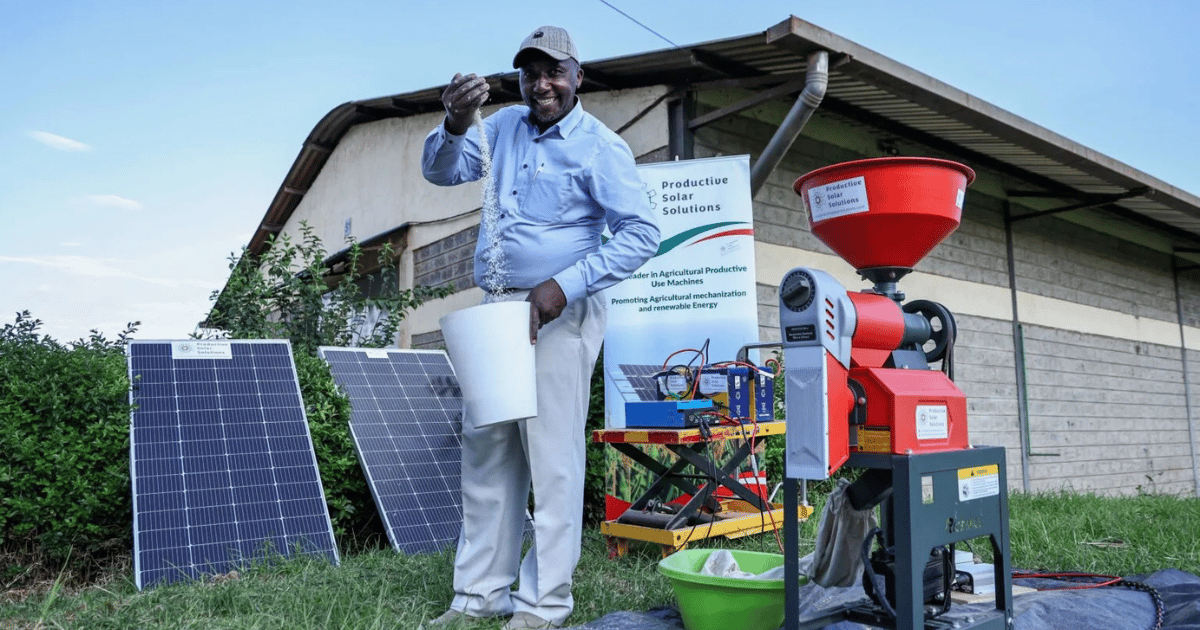

By replacing diesel with solar pumps, mini-grids and energy-efficient agro-processing equipment, farmers can cut production costs and generate more revenue while improving food security. This transition mirrors the diesel displacement trend already underway in telecommunication towers and mining operations.

The economic stakes are enormous. Africa holds 60% of the world’s unused arable land, amounting to 874 million hectares. This is more than the combined size of South Africa, Nigeria, the Democratic Republic of Congo, Sudan, and Ethiopia. Yet, productivity lags far behind global averages. Inadequate energy access remains one of the biggest bottlenecks—irrigation covers less than 10% of cropland, and up to 40% of food spoils before reaching markets due to poor cold storage. Expanding energy access to the cold chain alone could unlock about $20 billion by 2030.

This initiative follows earlier attempts to provide clean energy to the more than 600 million people in Africa who still lack access. Companies like Sun King, M-KOPA, and Bboxx used pay-as-you-go (PAYGo) models to electrify millions of households. While they proved that decentralised solar could scale, the sector has struggled with repayment risks, high distribution costs, and policy uncertainty. Quality issues also persisted, with some products failing to deliver as promised.

Then came mini-grids, which were hailed as the solution to meet big energy demands in rural areas. Yet, despite strong donor backing, mini-grids have struggled to achieve commercial viability due to low rural incomes and the challenge of stimulating demand. Productive use of energy followed and was seen as the missing link, but uptake has been slow. However, momentum is gradually building.

The Agri-Energy Coalition could prove to be the final piece of the puzzle. By embedding energy demand into established agricultural value chains, it can avoid the pitfalls of previous initiatives. Irrigation systems, cold storage, milling, and processing already provide a reliable baseline of consumption, making projects more bankable and easier to finance.

Our take

The Agri-Energy Coalition will face similar problems to previous initiatives, particularly around financing and affordability. Most smallholder farmers lack credit histories and will require innovative financing mechanisms to make these technologies accessible without burdening them with unsustainable debt.

If the initiative succeeds, it could create ripple effects far beyond food and energy. It could spur investment in logistics, cold chains, and rural infrastructure, while also catalysing new financing models such as carbon credits for reduced diesel use.

Most importantly, it could help Africa pivot from being a raw commodity exporter to a value-added agri-processor, boosting incomes and reducing food imports.