- Renewables Rising

- Posts

- Banks & energy firms tap bonds for green power projects

Banks & energy firms tap bonds for green power projects

Dear subscriber,

The cash crunch in renewables demands out-of-the-box thinking and innovative business models. Today, financial markets are opening up to green bonds, and local renewables manufacturing capacity is growing. Will they deliver?

– Sammy Jamar, Editor

Zambia National Commercial Bank (ZANACO) has announced plans to issue the country’s first-ever sustainability bond, aiming to raise $100 million to finance renewable energy, sustainable agriculture, and climate-resilient infrastructure projects. This marks a major step towards funding initiatives that could help the country move out of load-shedding. |

Across Africa, momentum for green and sustainability bonds is slowly building, though volumes remain low compared to global markets. The continent accounts for less than 1% of the world’s $2.2 trillion green-bond market.

Energy companies have tapped into this trend. The Copperbelt Energy Corporation (CEC) became Zambia’s first energy firm to issue a green bond, raising $150 million over 15 years to fund 230 MW of solar projects.

Our take: If ESG rules survive the current backlash, they’ll likely drive asset managers to invest further in green bonds… Read more (2 min)

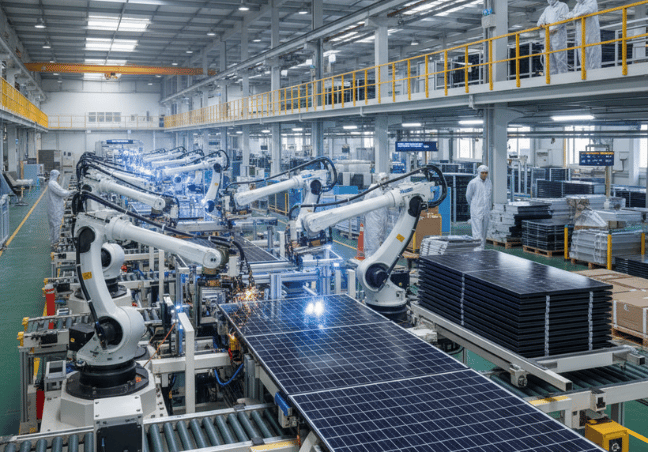

Nigeria has signed a deal with China’s LONGi to build a solar panel factory with an annual capacity of up to 1 GW. It’s the third such project since March, raising planned annual production capacity to over 4 GW and reflecting growing Chinese investment in Africa’s clean-energy manufacturing sector. |

Data from think tank Ember shows Nigeria imported 263 MW of solar cells from China in the nine months to September. This is 76 MW higher than the total for 2024 and signals continued strong demand.

LONGi joins companies like CSI Solar, China Glass Holdings, Kibing Solar, Sunrev Solar and JA Solar that either manufacture solar panels independently on the continent or through partnerships with local firms.

Our take: If governments pair Chinese capital with local content rules, the continent could become a solar manufacturing hub.… Read more (2 min)

The month of October attracted at least $19.6 billion in funding and commitments, according to the Renewables Rising funding database. South Africa topped the list, accounting for 70% ($13.9 billion) of total flows, while Gabon ranked second with $1.8 billion in hydropower funding expected to inject between 350-400 MW into the national grid. |

The month’s overall funding was more than double the total for August and September, which each recorded about $3.1 billion.

A total of 28 deals spread across 14 countries were announced, continuing the trend of investment reaching over a dozen markets and potentially more when multi-country funding deals are included.

Our take: Parallel policy progress signals a positive outlook where emerging markets may get closer to developed economies in attracting capital… Read more (2 min)

EEP Africa announces approval of 16 new clean energy projects spanning southern and eastern Africa (Source: EEP Africa LinkedIn)

Events

🗓️ Join a webinar on Tariff Determination Techniques & Subsidy Design (Nov 12)

🗓️ Register for the Africa Energy Expo 2025 (Nov 25)

🗓️ Be at the ESG, Impact Investing & Sustainable Finance Summit 2025 (Nov 27)

Jobs

👩🏻💼 Join d.light as a Regional Sales Manager (Uganda)

👷🏽♂️ Lead WastePlans’ zero waste initiatives (South Africa)

👷🏼♀️ Apply to Scatec Solar’s Project Finance Analyst role (Egypt)

Various

💡 Solar farm renewal in Cape Verde doubles electricity

💸 Kenya’s first PPP power line developers request Sh34bn from banks

🤝 UCT and Solarise Africa strengthen energy resilience for Health Sciences

🟢 Nigeria sets National Carbon Market Framework in place before COP30

Seen on LinkedIn

Youri Harel, Head of Energy, Infrastructure & Commodities at MCB Group, says, “Developers can design great projects and financiers can structure attractive terms, but if the offtaker — the utility — cannot be trusted to pay, the deal collapses.”