- Renewables Rising

- Posts

- Egypt leans inwards to fund energy transition

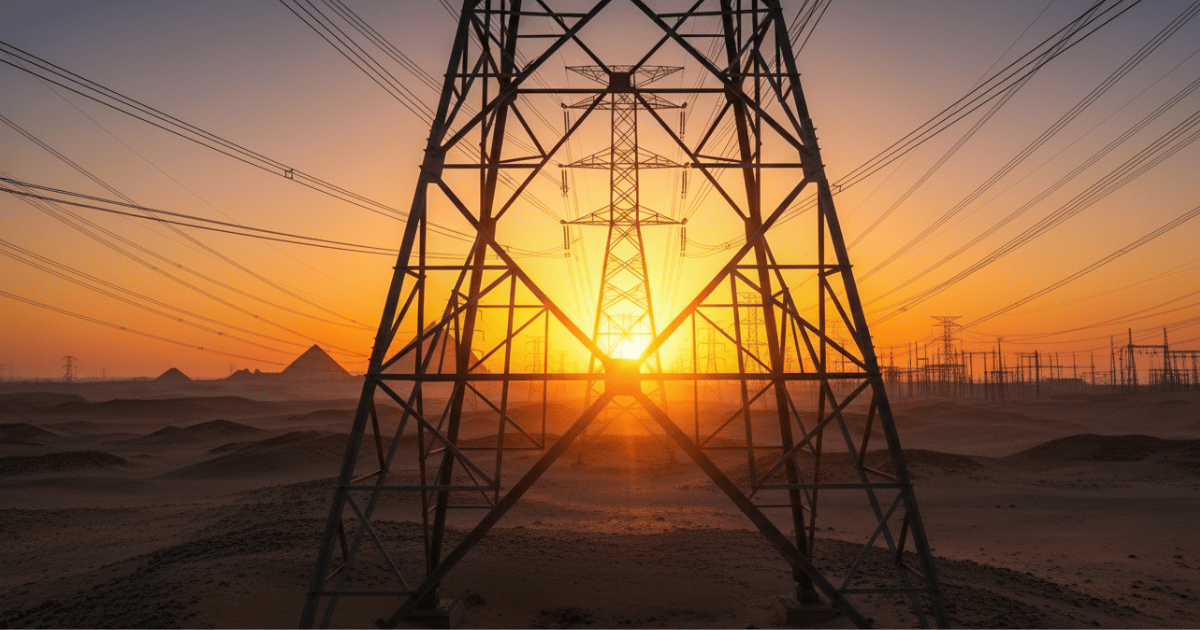

Egypt leans inwards to fund energy transition

From the newsletter

Egyptian government is set to invest $2.81 billion in the electricity and renewable energy sectors during the 2025-26 fiscal year, almost twice the $1.5 billion allocated last year. The initiative is part of a long-term roadmap that aims to quadruple the share of renewable energy generation from the current 11% to 42% by 2030 to support sustainable production.

While other countries depend on private investments for their energy sector, Egypt’s government is taking a different approach. It will provide 73% of the planned funding, while private investments will cover the remaining 27%.

The country is already on track to achieve this ambitious goal. The electricity sector confirmed that the unified grid successfully navigated the summer of 2025 without any recurring outages, thanks to infrastructure upgrades.

More details

Egypt plans to expand electricity access while increasing interconnection capacity with neighbouring countries for power trading. In addition, it aims to reduce electricity losses to 16.5% to ensure a greater share of generated power reaches consumers.

Historically, African governments have relied heavily on the private sector, including banks, multilateral lending institutions, and DFIs, to invest in renewables due to limited private sector readiness and the high upfront capital costs for renewable energy projects.

Egypt’s investment in renewables is significantly higher compared to other governments on the continent. For instance, Kenya allocated about $486 million to the energy sector, and South Africa just $84 million, despite its big challenges, with much investment expected to come from the private sector.

Its portfolio in renewables has grown significantly this year. The Renewables Rising project database shows at least 10 GW of projects in different stages of development for the year 2025 alone. Moreover, its success in renewables is partly because of its ability to mitigate intermittency using storage. We have recorded around 4 GW of battery energy storage solutions since the beginning of 2025, including the recently announced 1500 MWh AMEA Power stand-alone BESS plants.

While the government is investing heavily in renewables, the private sector has also been active in funding and developing utility-scale projects. Key players include AMEA Power, with their 300 MWh Kom Ombo Battery Energy Storage System project recently commissioned in 2025. Scatec also recently completed its 600 MW Benban Solar Park expansion project. Other notable private sector participants include ACWA Power, which has been active in several wind projects across Egypt.

The country is also in the process of implementing new electricity tariffs effective October, which will mainly affect old mechanical meters. The government is doing this as it plans to completely phase out subsidies and ensure cost-reflective tariffs.

Lastly, Egypt estimates needing $20.3 billion in total investments in the electricity and energy sector to achieve its electricity and energy goals. This means a total increase in money flow towards the sector that may require more than private sector participation. It officials have also acknowledged the need for more foreign capital in order to actualise the milestone.

Our take

Egypt's government is being pragmatic when it comes to its energy independence, particularly in renewables. Increasing the share of renewable energy sources means more clean, affordable, and sustainable power for Egyptian consumers, which supports economic growth.

The government's involvement, while not common in African nations, is possible and necessary to facilitate the clean energy transition. When governments actively participate, they can create enabling policies, de-risk investments, and coordinate infrastructure development that private markets alone may hesitate to undertake.

A collaborative environment where both public entities and private players get a share of renewables will be the key ingredient in the race for energy independence. These partnerships harness the strengths of each sector, accelerating the deployment of clean energy solutions and ensuring sustainability at scale.