- Renewables Rising

- Posts

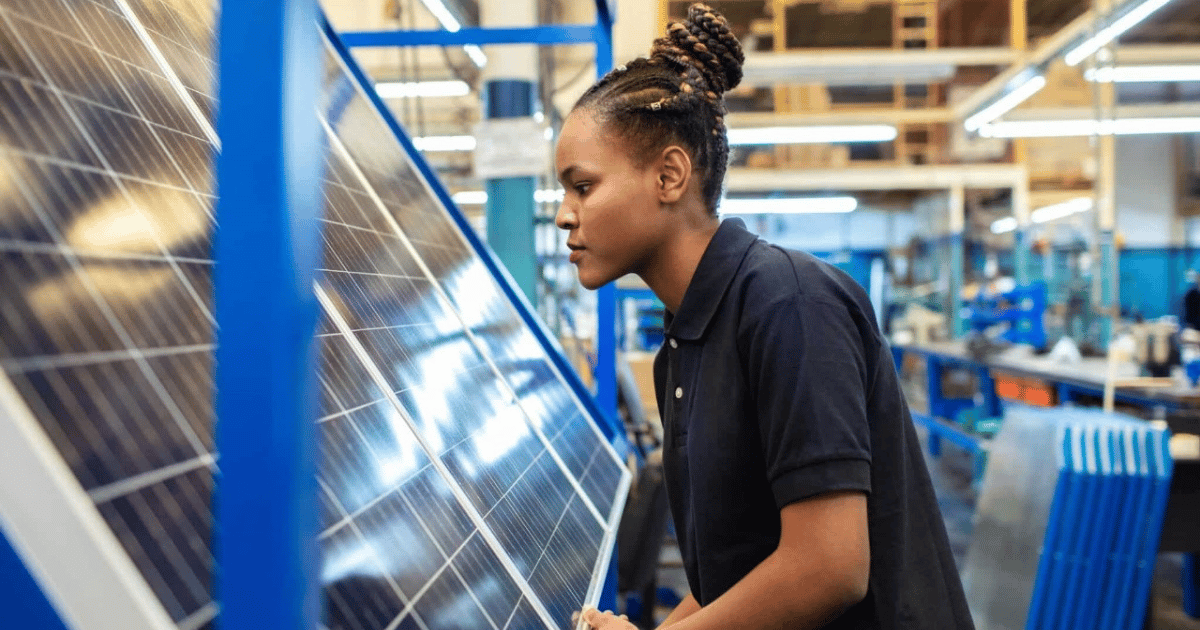

- Ethiopia is leaning towards local solar manufacturing

Ethiopia is leaning towards local solar manufacturing

From the newsletter

While many African countries have increased solar panel imports from China, Ethiopia is charting a different path. The country is importing solar wafers, the thin crystalline slices used to produce solar cells, to build its local industry. According to data platform Ember, it has imported wafers equivalent to 874 MW of solar capacity since the start of 2025.

Wafers are used to make solar cells, and those solar cells are then assembled to make solar panels, the large, flat modules that are now used to capture sunlight and convert it into electricity.

In early 2025, Ethiopia began producing solar cells in partnership with Japanese company TOYO, starting with an annual capacity of 2 GW. The facility is now undergoing expansion to double output.

More details

According to the data, Ethiopia began importing wafers in February, ahead of its official solar cell production by TOYO in April. The space for solar cell manufacturing in Ethiopia has attracted Asian manufacturers. In early June, three Chinese companies signed deals with the Ethiopian government to invest $460 million in solar cell manufacturing plants.

While Ethiopia is prioritising solar cell manufacturing, it is also giving growing attention to local assembly as an alternative to panel imports. Since the start of 2025, the country has imported at least 960 MW worth of solar cells, nearly five times more than Nigeria, the next largest importer, with South Africa trailing far behind. Ethiopia’s solar panel imports amounted to just 39 MW in the same period.

Across the continent, Africa’s solar panel assembly industry remains heavily reliant on imported solar cells, mainly from China. Most countries have focused on assembly because it is far less complex and capital-intensive than solar cell manufacturing, which requires advanced technology that remains largely unavailable on the continent.

The data shows that at least 30 African countries imported solar cells from China since January, totalling more than 1,800 MW of capacity. This clearly shows that many countries have functioning assembly plants. In contrast, Ethiopia is the only country to import wafers this year, highlighting its unique push toward upstream solar manufacturing.

Egypt is currently leading with gigawatt-scale projects under construction. EliTe Solar is building a 2 GW solar cell facility and a 3 GW panel production line, both expected to begin operations next month. Sunrev Solar is also developing a 2 GW facility for solar cells and panels. Nigeria, meanwhile, has focused mainly on assembly plants aimed at supporting rural electrification projects, with the government considering restrictions on panel imports to stimulate local demand.

A significant challenge that remains for most African countries is the availability of cheap and reliable power. South Africa is still not yet completely free from the threat of load shedding, while Nigeria's frequent blackouts are a nightmare. Egypt and Ethiopia, however, have better grids, with Ethiopia boasting one of the cheapest electricity tariffs in Africa. This has become a magnet for manufacturers who want to cut production costs.

Our take

No single country needs to do everything. Ethiopia can focus on wafers and cells, while others like Nigeria and South Africa scale assembly. Coordinated supply chains across Africa could create economies of scale and reduce costs.

Governments need to offer incentives, such as tax breaks, import duty reforms, and guaranteed demand through public procurement, to encourage manufacturers to set up plants locally.

Local manufacturing should be tied to expanding affordable access across the continent, especially for rural electrification. Otherwise, Africa risks becoming a low-cost production base without solving its own energy poverty.