- Renewables Rising

- Posts

- First locally made lithium-ion battery passes test

First locally made lithium-ion battery passes test

From the newsletter

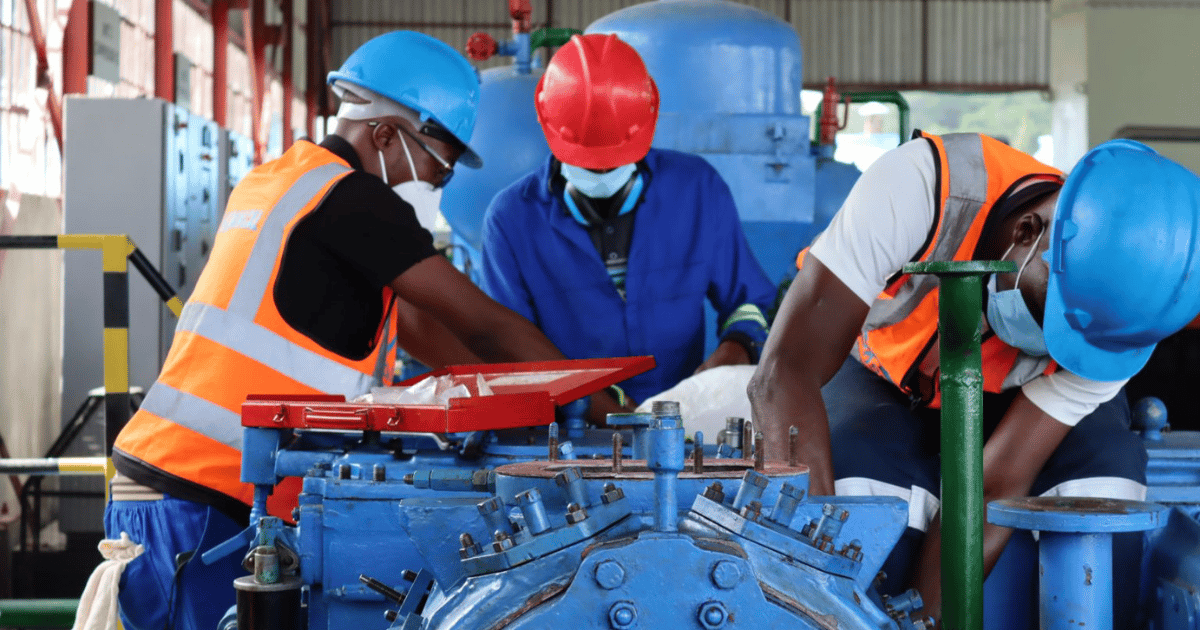

Zimbabwe's state-owned Verify Engineering has announced the success of its first locally produced lithium-ion battery, which recorded zero failures after undergoing a one-year test. This marks a new era for the mineral-rich country and comes as it prepares to ban the export of unprocessed lithium concentrate by 2027, aiming to retain more value from its resources.

The continent has long been a supplier of raw materials, paying for processing elsewhere. This has slowed down Africa's progress in renewable energy tech.

African battery energy storage projects are becoming ever more common, with demand projected to reach $4.4 billion by 2030, presenting a opportunity for local manufacturing.

More details

The lithium-ion battery underwent one-year trials to test its quality, achieving a zero failure rate last month, according to Pedzisai Tapfumaneyi, the company’s CEO. He noted that the battery is expected to have a lifespan of about ten years. This success now opens the next phase for local manufacturing in Zimbabwe, a country holding Africa's largest lithium deposits.

Tapfumaneyi stated that the company is now considering establishing a large-scale production facility to meet growing domestic and international demand. The government has long advocated for local beneficiation of strategic minerals, and this development is seen as a major boost to its ambitions within the clean energy supply chain.

This is particularly important given that Africa loses a significant portion of its potential revenue by exporting critical minerals in their raw form rather than processing them into higher-value products domestically. Estimates suggest that African countries capture only a fraction of the total value that could be realised through value-added processing, losing up to 60% or more of potential revenue.

To maximise the benefits from their mineral wealth, African countries are increasingly looking into the localisation of manufacturing, with some exploring regional mineral blocks and integrated value chains. For instance, South Africa plans to increase import duties on resources used for manufacturing renewable energy technologies to spur its local industries. The Democratic Republic of Congo, Zambia, and Morocco are collaborating on a regional electric mobility project that includes developing value chains for battery production and precursor materials.

The African Union is also championing local manufacturing. Earlier this year, it rolled out the African Green Minerals Strategy, which aims to transcend the traditional export of raw materials by promoting local beneficiation and industrialisation. The strategy focuses on promoting regional cooperation, through which countries can achieve economies of scale, attract more substantial foreign direct investment, and collectively secure a larger share of value in global supply chains.

Local manufacturing is critical for Africa to capture greater value within the global supply chain. When minerals are processed and transformed into finished goods domestically, it significantly boosts national economies through an increased share of value, the creation of diverse jobs, and the enhancement of local technical skills. This reduces reliance on costly imports, diversifies economic output, and builds resilience against global market fluctuations.

Africa's battery energy storage capacity is projected to grow by 22% annually until 2030, presenting an enormous opportunity for the continent to become a key player in the battery value chain. Furthermore, the growing electric vehicle market is projected to reach $28.3 billion in Africa by 2030, which will significantly amplify the demand for lithium-ion batteries, underscoring the strategic need for local manufacturing.

Our take

As Africa increases its adoption of solar, wind, and other intermittent renewable energy sources, battery storage will become increasingly essential for maintaining grid stability. This growing demand for battery storage, in turn, will be key to enabling larger-scale production of batteries, which can eventually lead to a significant reduction in manufacturing cost.

Building strong regional mineral economic blocs will be crucial for African countries. These blocs can ensure a continuous and stable supply of raw materials for manufacturing, and critically, help regulate the prices of end products. By establishing these integrated value chains, African countries can safeguard against global market volatility and secure better economic terms.

Engaging in local manufacturing provides Zimbabwe and other African countries with a stronger voice and more favourable negotiating terms on the global stage. Given Africa's substantial share of critical minerals required for green technologies, it will become an active participant in manufacturing rather than just raw material suppliers and also play a proactive role in shaping the future of global geopolitics.