- Renewables Rising

- Posts

- Kenyan hope for cheap power delayed by dam setbacks

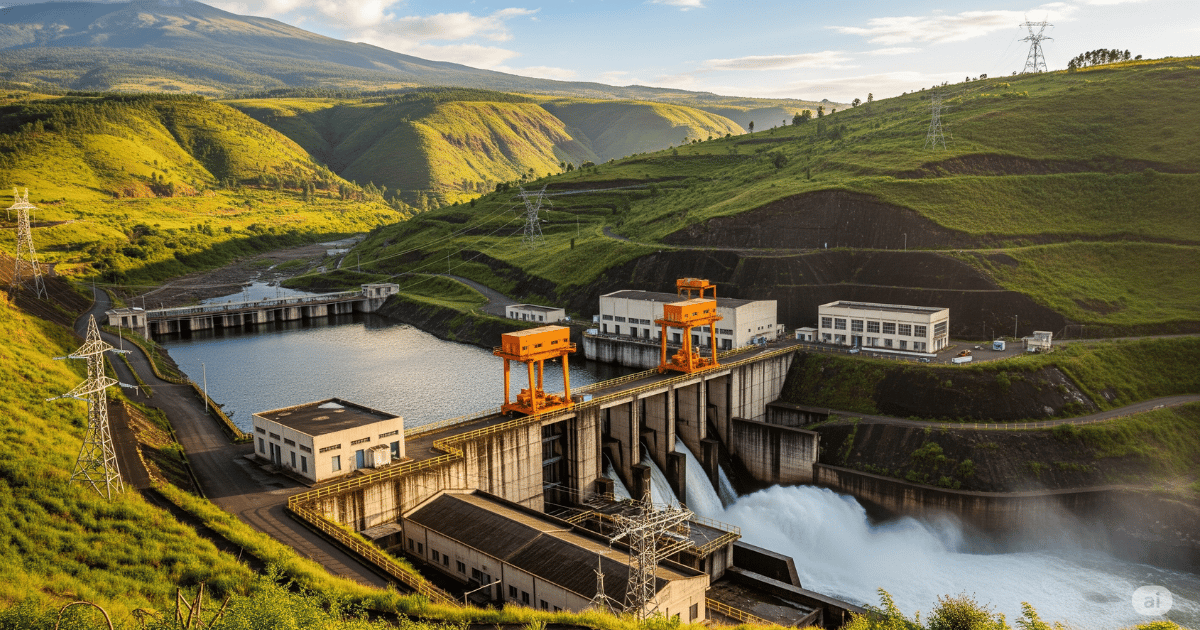

Kenyan hope for cheap power delayed by dam setbacks

From the newsletter

Kenya's quest for cheap power suffered a blow with the termination of its largest hydropower project, citing failure to meet a number of undisclosed conditions in the development plan. The project named High Grand Falls Dam was to generate 500 MW, and with plans to double that capacity to provide power to meet the country's growing demand.

The project was estimated to cost $2.61 billion and was to be built by GBM Limited, a UK-based engineering firm. Despite being terminated, the contracting authority for the project, the National Irrigation Authority, still has a chance to restart it by inviting new bidders.

Hydropower is crucial for providing cheap baseload power compared to other technologies. With the termination of the High Grand Falls project, Kenya will need to rely on imports from Ethiopia to meet immediate power needs.

More details

Construction of the High Grand Falls Dam was initiated by the private sector and was to be developed under a Public-Private Partnership framework. GBM Limited UK and its partners were slated to own and operate the High Grand Falls Dam for 30 years, during which they would recoup their investment before transferring ownership to the Kenyan government.

This multipurpose dam was expected not only to significantly increase hydropower in the national grid but also to provide water for irrigation-fed agriculture across 400,000 acres in Kitui, Tharaka-Nithi, and Embu counties.

Historically, hydropower has been a dominant player in Kenya's electricity sector. However, it now accounts for just 25% of generated power, with geothermal energy dominating at 40%. This shift is primarily due to a lack of major new hydropower projects being constructed, with the last large one completed in the early 2000s. Only small hydropower projects have been undertaken since, mainly for private generation, particularly in tea estates. Government efforts have focused on redevelopment projects, such as the ongoing Gogo Hydroelectric Project.

Most hydropower projects in Kenya have faced delays due to issues with land permitting and political interference. While the country possesses a potential for over 10,000 MW of total hydropower capacity, only about a tenth of this has been realised. Despite these challenges, hydropower remains Kenya's cheapest source of electricity for the national grid, averaging Sh3.83/kWh. This is significantly lower than geothermal at Sh10.28/kWh and imported hydropower at Sh10.69/kWh.

Even the High Grand Falls Dam was considered vital for boosting the supply of cheap hydroelectricity to the national grid, with a projected cost of Sh10.34/kWh, and this will go down when the project is fully amortised.

With the project's cancellation pending re-advertisement, Kenya faces the risk of continued power supply deficits, which could hinder its long-term industrialisation plans. However, hydropower is not Kenya's only resource. The country possesses abundant geothermal, wind, and solar potential, collectively capable of generating over 50,000 MW of clean electricity. Geothermal, in particular, is highly suitable for generating low-cost baseload power and typically faces fewer interferences as it does not require large-scale displacement of people like hydropower.

Solar and wind energy also offer promising solutions due to their modularity, which allows projects to be connected to the grid more quickly through phased development. The primary challenge with these sources is the need to have battery storage to meet Kenya's peak demand, which occurs between 7 PM and 10 PM when the sun goes down. Nuclear energy could also present a low-carbon electricity alternative, but it demands more extensive long-term planning due to the inherent risks associated with such projects.

Our take

The challenges faced by major hydropower projects are not unique to Kenya; many other African countries experience similar issues. Therefore, focusing on smaller-scale projects might be a more pragmatic approach for Kenya in the short to medium term. The country should actively seek to incentivise these smaller projects to facilitate their scale-up.

Additionally, Kenya needs to establish and strengthen interconnections with neighbouring countries that have surplus electricity. Given that Uganda, Ethiopia, and Tanzania currently have interconnectors with Kenya, it should look to strengthen bilateral agreements with these countries.

Alternatively, as a member of the East African Power Pool (EAPP), Kenya should advocate for the full operationalisation of the regional electricity market. This would create a more competitive market, potentially leading to lower electricity prices for Kenya compared to relying solely on bilateral agreements.