- Renewables Rising

- Posts

- The debate about power subsidies resurfaces

The debate about power subsidies resurfaces

Dear subscriber,

To subsidise or not? Whatever path utilities take, the grid-versus-off-grid competition is only intensifying. Banks are lining up with easier financing options for businesses. It’s time for a rethink on what truly drives access.

– Sammy Jamar, Editor

Nigeria this week announced targeted electricity subsidies for vulnerable families, while South Africa plans to quadruple free power for low-income homes to 200 kWh per year. Subsidies for rural communities cost governments billions and have pushed utilities into debt. Yet they remain vital for connecting the rural poor. |

Subsidies sit alongside official moves to increase competition with off-grid companies serving the same customers, pushing for better and more affordable power.

Countries like Ethiopia have recently lowered subsidies by raising electricity tariffs, hoping to create a more level playing field between the national grid, off-grid providers and independent power producers.

Our take: There is a need to use digital tracking systems to ensure that support only reaches those who truly need it… Read more (2 min)

Stanbic Bank Kenya has partnered with solar energy company Safer Power Limited to provide 100% financing for SMEs investing in solar. The move underscores a trend in banking, where institutions increasingly prefer lending to businesses over households, viewing SMEs as lower-risk and more capable of repaying loans. |

Captive power has grown to 603 MW in Kenya, representing 15% of its installed capacity. Solar makes up half of this as businesses adopt it for reliability and cost savings.

Stanbic joins KCB bank, which recently partnered with renewable energy firms Sentimental Energy and Miale Solar to provide schools with collateral-free green loans for solar solutions.

Our take: This could be the beginning of solar-as-a-service, with energy treated as an essential service rather than a capital expenditure… Read more (2 min)

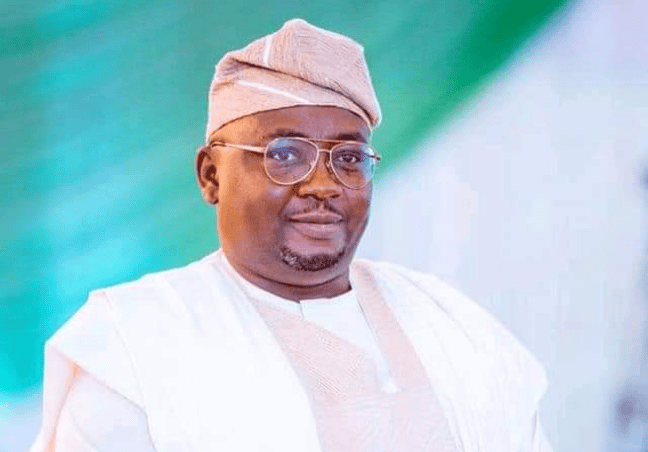

Nigeria has come far in creating supportive energy policies, and the recent Energy Act was seen as a milestone. But two years on, even before full implementation, the government is already revising key provisions. Add currency woes, corruption and poor agency coordination, and investors shy away, writes Kolajo Onasoga in today's opinion piece. |

“Investors can live with risk, but not with confusion. Right now, Nigeria feels like confusion wrapped in potential,” writes Ms Onasoga.

She is an energy strategist focused on Africa’s power and renewable energy markets. Her work includes helping clients structure investments, navigate regulations, and design energy transition strategies.

Read the full opinion article here… Read time (3 min)

BIOKO Consulting & GENESIS Energy Holding partner to launch the Energy to Africa Initiative (Source: Gabriel Mbaga Obiang Lima)

Events

🗓️ Attend the Powerelec Kenya 2025 event (Nov 11)

🗓️ Be at the West African Clean Energy & Environment Trade Fair (Nov 11)

🗓️ Sign up for Tariff Determination Techniques and Subsidy Design (Nov 12)

🗓️ Take part in the BC technology and solar returns webinar (Nov 27)

Jobs

💼 Become Sun King’s Area Business Manager (Nigeria)

🧑🏻💻 Spearhead CrossBoundary’s learning experience activities (South Africa)

🦺 Join Power For All as an Electrical Engineer (Uganda)

Various

💰 ElectriFI invests $2.88 m in solar and storage company Sawa Energy

🔋 Garowe’s 10 MW solar and 20 MWh storage boosts Somalia’s power supply

⚡ Morocco could deploy as much as 28.6 GW of distributed solar

💡 Zimplats expands energy generation with 45 MW solar plant in Zimbabwe

Seen on LinkedIn

Segun Odukoya, ESG Manager at Rensource Energy, says, “The financing gap isn’t just about international donors; local institutional investors (pension funds, insurance firms, sovereign funds) control over $1.3 trillion in assets, but less than 2% is allocated to green infrastructure.”